alameda county property tax rate

Excluding Los Angeles County holidays. We are accepting in-person online and mail-in property tax payments at this time.

Alameda County Ca Property Tax Search And Records Propertyshark

Effective October 1 2021 we are resuming limited in-person services at the Kenneth Hahn Hall of Administration Monday through Friday between 800 am.

. So if your home is worth 200000 and your property tax rate is 4 youll pay about 8000 in taxes per year. The County is committed to the health and well-being of the public. You can also search by state county and ZIP code on.

County By County Migration Data Pulled From Us Tax Records Data Visualization Map Migrations United States Geography

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Awesome Howard County Tax Department In 2022 Howard County Ellicott City Albemarle County

Property Tax By County Property Tax Calculator Rethority

Prop 19 Ahead Would Change Residential Property Tax Transfer

Transfer Tax Alameda County California Who Pays What

Understanding California S Property Taxes

Cook County Treasurer S Office Chicago Illinois

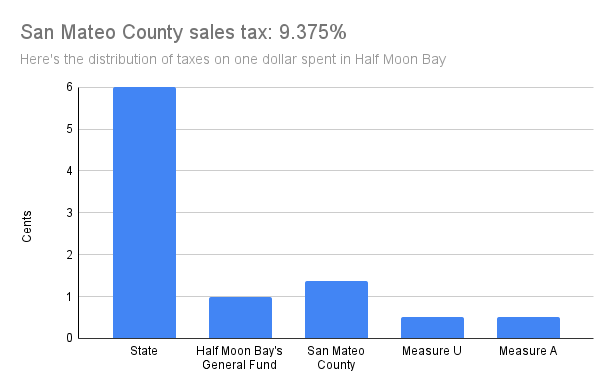

County Begins Collecting Higher Sales Tax Local News Stories Hmbreview Com

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Search Unsecured Property Taxes

Pin On Articles On Politics Religion

Alameda County Ca Property Tax Calculator Smartasset

California Public Records Public Records California Public

Alameda County Ca Property Tax Calculator Smartasset

Alameda County Property Tax Tax Collector And Assessor In Alameda

How To Calculate Property Tax Everything You Need To Know New Venture Escrow